I found a lot to like in James Pethokoukis’s critique at The Week of the belief among conservatives about present economic growth. For example this:

Third, blaming Obama as the main cause for a historically weak recovery is a problematic narrative, though handy for “owning the libs.” Lehman Brothers declared bankruptcy a decade ago this week, shocking the global economy. Now generally the worse a downturn, the stronger the subsequent upturn — like plucking down on a guitar string, as Milton Friedman famously analogized. This perfectly describes the bad 1980s recession and subsequent “Reagan recovery.” But research suggests recessions accompanied by systemic shocks to the banking system and housing market are different: Recoveries are painfully slow, just like the one the American economy went through. As Goldman Sachs sees it, “The post-2008 U.S. recovery has not been unusually weak or prolonged relative to other financial crisis episodes.”

and I give a thumbs-up to this:

So should Trump offer an unironic “Thanks, Obama”? Well, a 2017 research review by the Philadelphia Fed found it likely that “the economy did indeed grow more than it would have without the [2009 Obama] stimulus but likely not as much as it might have with a different type of stimulus.” So that’s something.

but on this:

Second, the best measure of whether there’s been a fundamental change in the economy’s pace and course is productivity growth, which is the key to higher living standards over the long term. Productivity growth downshifted hard in 2005 — pre-Obama, pre-financial crisis — and then barely grew over the course of the recovery. Only since summer 2016 has it perked up somewhat. It’s going to have to do a whole lot better if the economy is going to grow anywhere near as fast in the future as it has in the past given slower workforce growth. No record-setting productivity growth, no miracle economy.

I think he may be missing the boat. I think it’s possible that more of the economic crisis, more of the phlegmatic recovery from 2009-2015, and more of the stronger growth presently in place can be attributed to energy prices particularly oil prices than anybody seems willing to say.

So, let’s not count our chickens before they’re hatched, shall we? Oil prices are rising again.

I’m not sure why you would reach into the variables bag and pluck that one out. Retail gas prices have pretty much steadily risen all throughout Trump’s term. The pump price at inauguration was about what it averaged the prior two years. And yet it appears there has been an inflection point in economic performance.

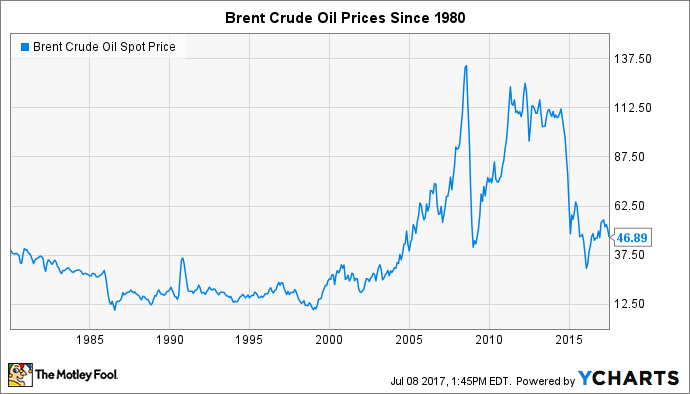

The narrative that has been promoted about the Great Recession is that it was primarily a financial crisis. The narrative that has been promoted about the economy since 2012 is that although the ARRA “saved” the economy lack of follow-through by the Obama Administration resulted in lacklustre growth. I’m skeptical of both narratives. First, consider this chart

What caused the collapse of the housing bubble? It collapsed because it had run its course? Or did it collapse because very high oil prices made it unworkable?

Was it the Obama Administration’s fiscal and financial policies that kept the economy stuck in first gear or was it the Administration’s energy policies?

Is it the Trump Administration’s tax policies that have supported the increases in economic activity or is it the Admnistration’s energy policies?

Note that the increase in economic activity began in 2015, coincident with a sharp decline in oil prices and has continued since.

I believe the world is too complicated for single-factor explanations. There’s more than one thing going on but IMO energy prices are not being considered sufficiently.

That liquidity problems in the commercial paper market caused a “financial crisis” is undeniable. However I agree with you, especially when it comes to the observation on single-factor explanations, that the catalysts are a bit more murky. Did the housing bubble simply mean revert out of nowhere? (I doubt it; look at home prices today.) Did interest rate resets act like a tax? Did gas prices act like a tax? Did simple inflation combined with stagnant wages act like a tax? (As an aside, how do you square your view that taxes don’t matter much with such observations?)

The fact remains, gas prices have risen steadily throughout the Trump administration, whereas they were flat (though volatile) during the last two years of Obama’s 2% economy. That’s not where I would go looking first. I would also note that the money spigot was wide open during most if not all of Obama’s tenure. Rates are rising now.

I understand the politics of Obama and his supporters wanting to salvage his legacy by claiming credit. They’ve had their noses rubbed in the shit of their dour and fatalistic economic predictions. But the simple fact is that the economy kicked into a higher gear. There is a laundry list of statistics supporting that. Trump’s policies, of all sorts, plus the notion that he is the anti-Obama when it comes to the business environment has had an effect. What lies in the future, I certainly don’t know. What will the Fed do? How messy will the trade battle get?

Let me clarify: I don’t think that businesses or individuals respond to tax cuts immediately. It takes some time for the effects of a tax cut to be felt and that is more true the larger the company and the richer the individual receiving the tax cut.

The effects of cuts in the payroll tax will be felt quickly in the form of increased consumer spending or saving. The effects of a cut in the corporate income tax will take longer. GM doesn’t turn on a dime. It can take years for a new project to run through its approval mill.

I think that all parties should be able to agree definitively that the assertions that 2% growth was as good as it gets were wrong. It’s not quite as clear why they were wrong. There have been a lot of things going on at the same time including the tax cuts, a reversal of Obama’s regulation of various energy sector segments, and an economic downturn in China coupled with Xi’s going after more power both of which you would expect to result in investment moving out of China to someplace else. We’re someplace else.

The personal income tax being structured as it is meant that the tax cut went heavily to the top 1% and above of income earners. That stands to reason since they pay so much of the tax. Heck, my wife and I are in the top 3% of income earners and we’ll probably pay more tax as a result of the structure of the tax cut.

The higher the income, the greater the likelihood that the results of the tax won’t be reflect in consumption or investment but in savings and although savings may mean more economic activity tomorrow it probably doesn’t mean more economic activity today. That leaves us without a good explanation for why a tax cut structured as the recent one was would result in more economic activity today all by itself.