Let’s jump to the end of economist Eugene Steuerle’s Washington Post op-ed on how our present fiscal situation is different from that at the end of World War II:

Budgetary shortfalls are good in bad times, bad in good times — and horrible when scheduled regardless of the times.

while I didn’t know whether to laugh or cry at his prescription:

To make room for tomorrow’s needs, Republicans need to agree that tax rates must be set high enough to cover spending in good times, while Democrats must agree to schedule significantly less automatic future growth in spending. That leaves to future Congresses both sustainable budgets and enough slack to address future problems, whether another pandemic, recession or war, or how our spending and tax policies have largely abandoned low- and moderate-income working families — the ones suffering the most economically in the current crisis.

At present the only thing that Republicans actually agree on is that federal tax rates should be cut while Democrats generally think that automatic future growth in federal spending constitutes an advance over enacting ad hoc budgets year after year. Can we agree that neither party will abandon its own self-identity in the interest of fiscal prudence?

As for those who think that we can continue to extend ourselves credit indefinitely and spend it on whatever we care to without adverse consequences, I have several points to make. First, that might actually be true if aggregate product were growing faster. But it isn’t and I don’t believe that without specific, focused attention it will.

Second, to quote Paul Krugman’s terse response to Modern Monetary Theory it just doesn’t work that way.

Finally, you simply cannot consider yourself to be forming your views based on science or data and believe that. The best knowledge we have now tells us that economic growth slows at higher levels of public debt. The present level of debt is going to be a headwind to growth forever.

And no one talks about interest on the debt, which we are paying. In FY2020 it’s $479 billion. To put that in perspective, that’s almost 1/3 of the entire discretionary budget. The CARES act’s $1.8 trillion in additional debt will push that over $500 billion next year. And that’s before additional borrowing is factored in due to future Covid spending packages and the borrowing that will be necessary thanks to the inevitable decrease in tax receipts. Interest on the debt alone next year or the year after could easily approach $600 billion at which point it will be within throwing distance of the DoD budget in terms of size.

So yeah, the fact that we can borrow is great, but the idea that it doesn’t come with any costs is ludicrous.

Neither party has been willing to cut spending, they just differ on what they are willing to cut. The GOP always cuts taxes, increasing deficits. Even with an economy that conservatives considered to be the best the country has ever seen we were still increasing our debt. This will be tough to solve, but especially because of the ideology involved.

Steve

I avoided mentioning this in the post but there is a quasi-religious belief in the power to raise revenues by increasing marginal personal income tax rates. Experience seems to suggest that, while it is possible to reduce revenue by cutting marginal rates, after a certain point raising rates is not effective in increasing revenue

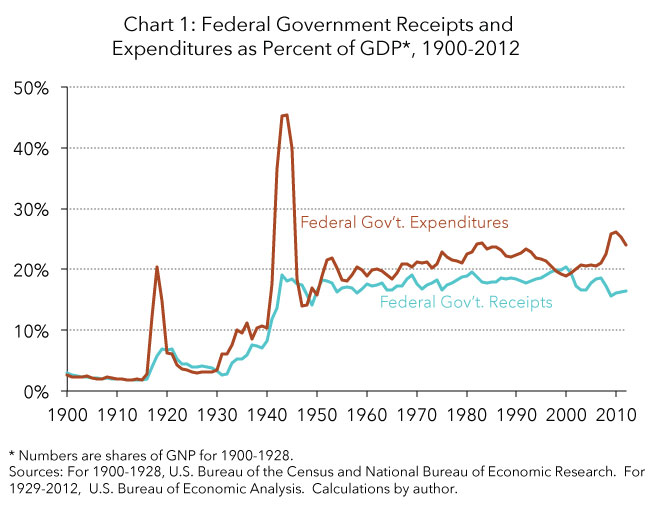

but it is a highly effective in promoting rent-seeking. In the chart above note that in 1940 the top marginal rate was 81%, in 1960 it was 91%, and in 2000 it was 39.6% but how relatively flat the line is.

Shorter: marginal rates and effective rates aren’t the same thing.

If you want to increase revenues abolish the personal income tax and impose a VAT. Alternatively, make sure that GDP grows. That will drive revenue increases.

Get rid of the corporate income tax and add the VAT. Eliminate millions of dollars of legal fees by the big corporations spent on avoiding 10s of millions of taxes. Eliminate the corruption. Need to read up and see how the wealthy will lan to avoid the VAT.

Steve